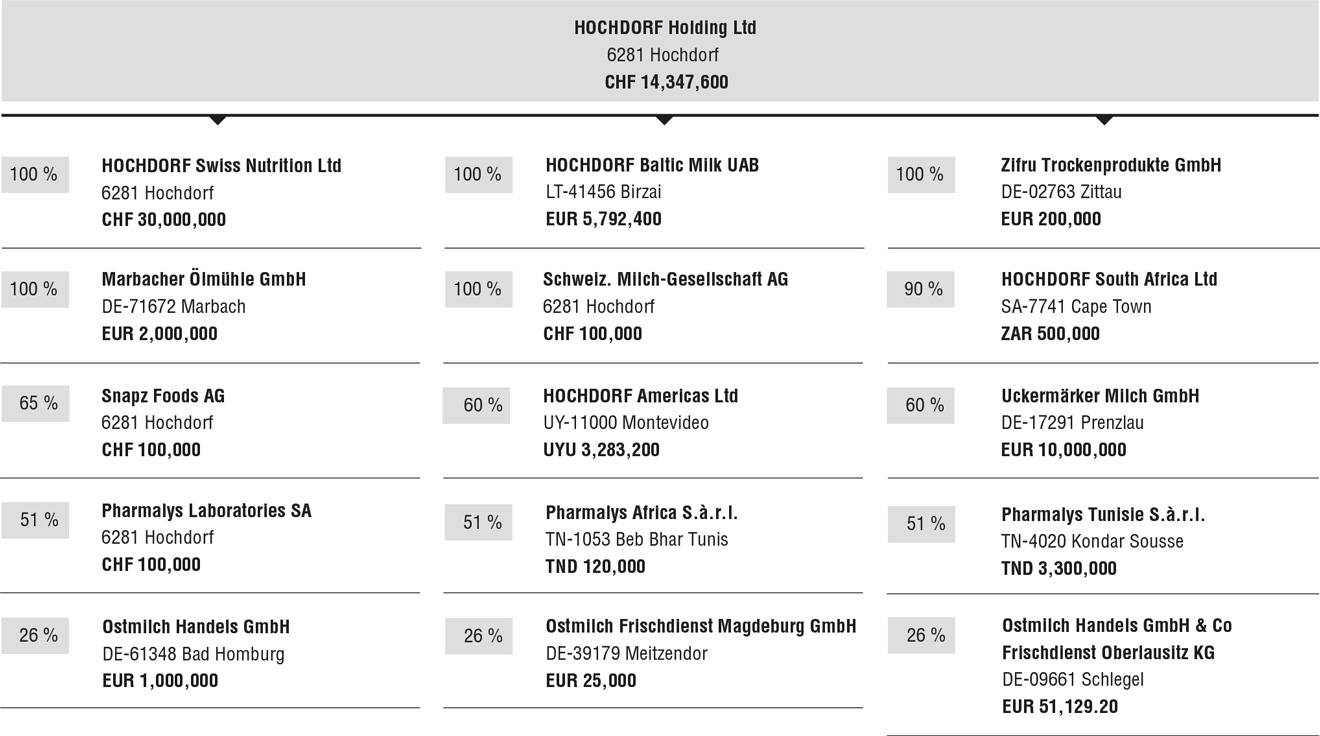

1.1. Group structure as at 31 December 2017

The Group structure of the HOCHDORF Group (hereinafter referred to as «HOCHDORF») is detailed on the following page. All shareholdings are listed on page 70 of the Annual Report, including their registered office, share capital and shareholding ratio. Apart from HOCHDORF Holding Ltd, which is listed, the consolidated group consists exclusively of non-listed subsidiaries. The purpose of the Group structure is to provide the best possible support for the company’s business activities within an efficient legal, financial and strategic framework. The structure should therefore be as simple as possible and transparent for outside parties

1.2. Significant shareholders

Significant shareholders with more than 3% of the voting rights are listed on page 68 of the Annual Report. Various notifications were received in the reporting period in accordance with Article 120 of the Swiss Financial Market Infrastructure Act (FMIA). Innovent AG, Wollerau, and the Weiss family, Wollerau, form a group within the meaning of Article 120 FMIA and hold 5.35% of the capital and the voting rights (previous year 5.35%). Taaleri plc, Helsinki, Finland, and Taaleri Fund Management Ltd, Helsinki, Finland, form a group within the meaning of Article 120 FMIA and hold 3.14% of the capital and the voting rights via their funds Taaleri Micro Rhein Fund and Taaleri Rhein Value SICAF Fund (previous year < 3%). Gebrüder Maurer GmbH, Zenith Gewerbepark GmbH, Maurer-Bertschi GmbH, Maurer-Schöni GmbH, all based in Hunzenschwil, form a group within the meaning of Article 120 FMIA and hold 3.01% of the capital and the voting rights (previous year < 3%). The disclosure notifications in connection with shareholdings in HOCHDORF Holding Ltd are published on the electronic publication platform of SIX Swiss Exchange and can be accessed via the search page of the disclosure office using the following Web link: www.six-exchange-regulation.com/en/home/publications/significant-shareholders.html.

HOCHDORF Holding Ltd is not aware of any other shareholders or groups of shareholders that held 3% or more of the total voting rights of HOCHDORF Holding Ltd. as at 31 December 2017.

1.3. Cross-investments

There are no cross-investments with other companies involving capital or voting rights.