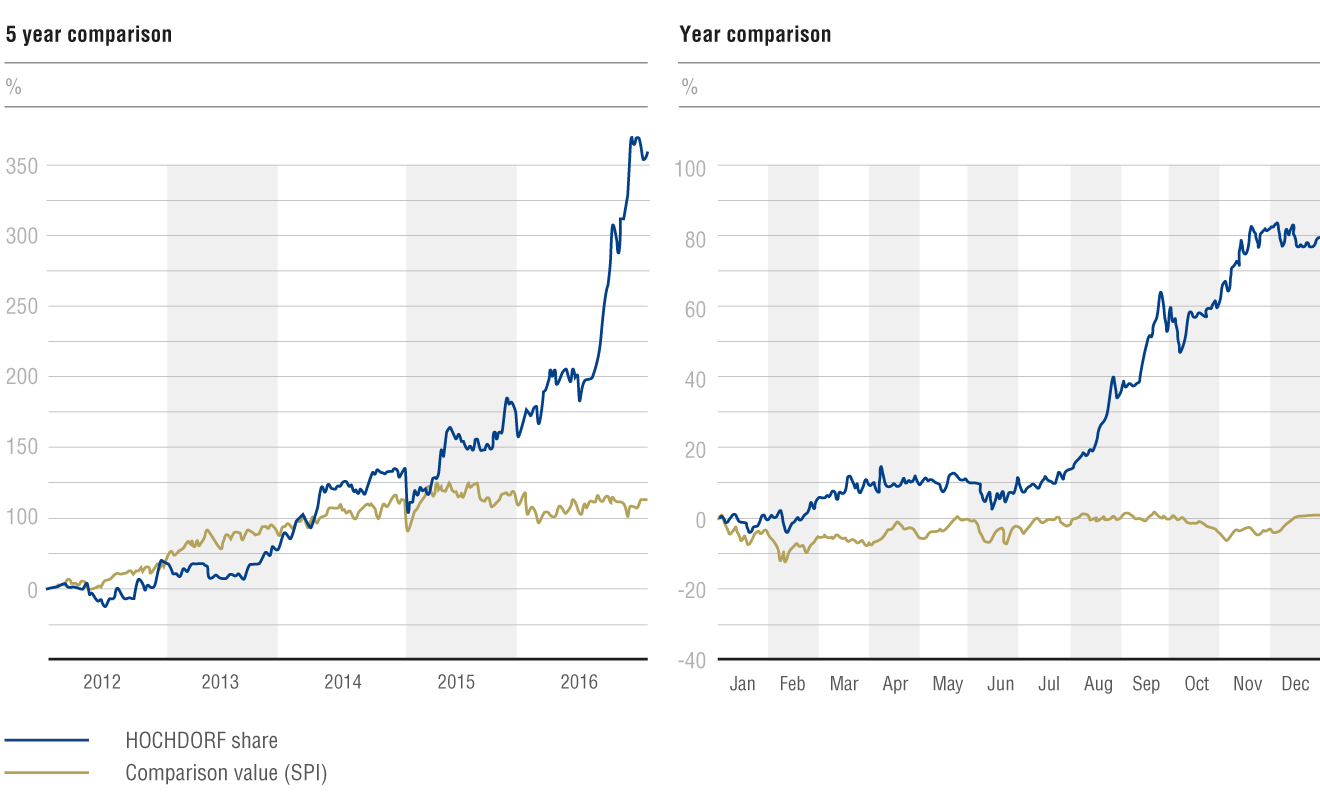

Share price development in 2016

The share price development for HOCHDORF Holding Ltd was extremely pleasing in 2016. The stock achieved the second-best annual performance of all the securities listed on the SIX Swiss Exchange. The most noticeable price increase took place in the fourth quarter of 2016. The price at close of trading on 30 December 2016 was CHF 309.75 (31 December 2015: CHF 168.70). That represents a price increase of +83.6 %, while the Swiss Performance Index (SPI) recorded a zero-sum game over the whole of 2016. When viewed over the last five years (1.1.2012 – 30.12.2016), the price increase for the HOCHDORF share amounted to +313 %. As of 31 December 2016, HOCHDORF Holding Ltd had 1,434,760 registered shares (no change over previous year). The market capitalisation also rose accordingly by +83.6 % to CHF 444.4 million (previous year: 242.0 million).

HOCHDORF Holding Ltd is listed on the SIX Swiss Exchange (ISIN CH0024666528). At the end of 2016, the market capitalisation was CHF 444.4 million.

Dividend

On the basis of the good results and taking into account the major capital investments, the Board of Directors is applying to the Annual General Meeting for a dividend payment from capital investment reserves of CHF 3.80 per share (previous year CHF 3.70). With the slight dividend increase, a dividend return of 1.23 % is achieved as at the closing date, 30 December 2016. This cautious and sustainable dividend policy will thus be continued.

The dividend to be paid from capital investment reserves is tax free for natural persons resident in Switzerland who hold shares as personal assets.

Shareholders according to category at 31 December 2016

| Description | Registered shareholders |

| Natural persons | 1,837 |

| Legal entities | 91 |

| Pension funds | 15 |

| Insurance companies | 4 |

| Investment company/fund | 26 |

| Other trusts | 5 |

| Banks | 16 |

| Public corporation | 4 |

| Total | 1,998 |

Shareholders according to breakdown at 31 December 2016

| Number of shares | Registered shareholders |

| 1 – 10 | 225 |

| 11 – 100 | 1,025 |

| 101 – 1,000 | 637 |

| 1,001 – 10,000 | 93 |

| 10,001 – 100,000 | 17 |

| 100,001 or more | 1 |

| Total | 1,998 |

Disclosure of equity holdings

According to Article 120 of the Federal Act on Financial Market Infrastructures and Market Conduct in Securities and Derivatives Trading (Financial Market Infrastructure Act, FMIA), anyone who in direct or indirect consultation with third parties acquires or sells on his own account the shares of a company based in Switzerland, the equity holdings of which are wholly or partially listed in Switzerland, or of a company based abroad, the equity holdings of which are wholly or partially listed in Switzerland, and thus reaches, falls short of or exceeds the limit value of 3, 5, 10, 15, 20, 25, 33⅓, 50 or 66⅔ per cent of the voting rights, whether these are exercisable or not, must disclose this to the company and to the stock exchanges on which the equity holdings are listed.

Financial calendar

- Annual General Meeting

5 May 2017 - Dividend payment

11 May 2017 - Half-yearly statement 2017

17 August 2017

Key indicators for the HOCHDORF Holding Ltd stock

| 2016 | 2015 | 2014 | 2013 | 2012 | ||

| Share capital at 31.12. | TCHF | 14,348 | 14,348 | 10,709 | 9,000 | 9,000 |

| Number of shares at 31.12. | Units | 1,434,760 | 1,434,760 | 1,070,922 | 900,000 | 900,000 |

| Nominal value per share | CHF | 10.00 | 10.00 | 10.00 | 10.00 | 10.00 |

| Profit/loss (–) per share | CHF | 14.12 | 11.73 | 17.45 | 6.95 | –39.69 |

| EBITDA per share | CHF | 23.25 | 21.23 | 25.40 | 20.11 | 15.91 |

| EBIT per share | CHF | 15.66 | 14.04 | 18.69 | 11.44 | 3.07 |

| Cash flow (earned capital) per share | CHF | 22.45 | 17.33 | 23.63 | 20.14 | 15.01 |

| Equity per share | CHF | 31.92 | 134.37 | 133.69 | 115.30 | 110.85 |

| Dividend per share | CHF | 3.801) | 3.70 | 3.70 | 3.20 | 3.00 |

| Peak price | CHF | 320.00 | 178.00 | 141.30 | 105.30 | 89.95 |

| Lowest price | CHF | 163.00 | 107.50 | 100.80 | 79.20 | 66.00 |

| Price at close of trading on 31.12. | CHF | 309.75 | 168.70 | 138.00 | 104.00 | 88.25 |

| Average trading volume per day | Units | 2,650 | 2,312 | 1,202 | 804 | 940 |

| P/E (price/earnings ratio) at 31.12. | 21.94 | 14.4 | 7.9 | 15.0 | n.a. | |

| Dividend return | % | 1.23 | 2.19 | 2.68 | 3.08 | 3.40 |